Homepage > CMRC understandings > 【CMRC】During the current domestic real estate winter, how to view the development of the industry coating field?

Hits:119 Createtime:2024-04-17 10:49:50

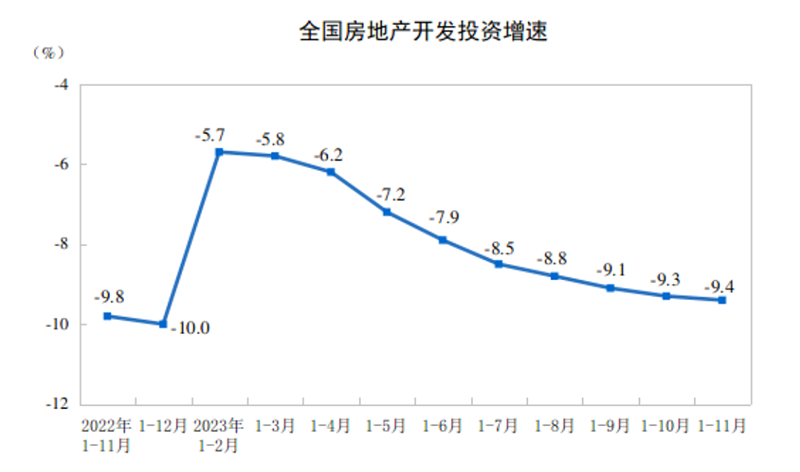

From January to November, the investment in real estate development was 10,404.5 billion yuan, down 9.4% year on year; Among them, residential investment was 7,885.2 billion yuan, down 9.0%.

Figure 1 National real estate investment growth rate

From January to November, the housing construction area of real estate development enterprises was 8313.45 million square meters, down 7.2% year-on-year. Among them, the construction area of residential buildings was 5.853.09 million square meters, down 7.6%. The newly started housing area was 874.56 million square meters, down 21.2%. Among them, the newly started residential area was 637.37 million square meters, down 21.5 percent. The area of completed houses reached 652.37 million square meters, up 17.9 percent. Among them, the completed residential area was 475.81 million square meters, an increase of 18.5 percent.

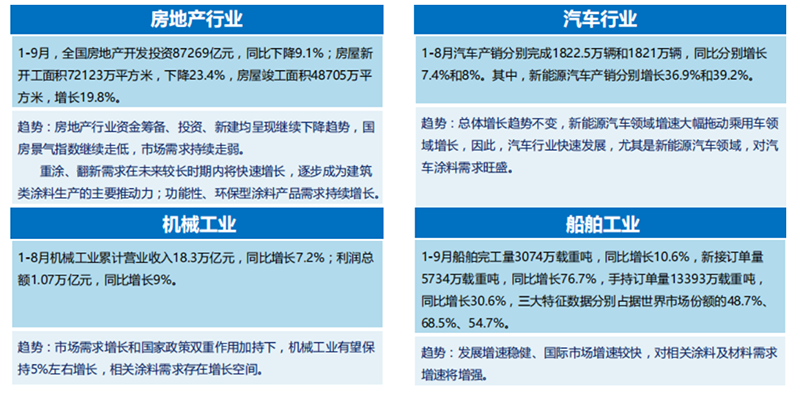

Figure 2 Downstream analysis of the national paint field

From January to September 2023, the overall development of the paint industry: The total output of paint from January to September was 26,910,800 tons, an increase of 4.7% over the same period last year. From January to September, the total revenue of the main business was 299.301 billion yuan, a decrease of 4.2% over the same period of last year, and the total profit was 17.641 billion yuan, an increase of 11.7% over the same period of last year.

From January to August, China's paint exports continue to maintain double-digit growth, and the number of imports is gradually decreasing. It is expected that in the second half of 2023, the coatings industry as a whole will maintain steady growth. Due to objective reasons, the base in 2022 is low, and the base in 2021 is high. Comparing the two years, the output increases by 1% ~ 2%, the main business income increases by -1%, and the total profit increases by about -3.8%.

The number of coating enterprises in China is large and the competition pattern is scattered. From the perspective of domestic TOP10 enterprises, among the top 10 coating enterprises in China in 2022, 6 foreign-funded enterprises are listed, and the top 3 are foreign-funded enterprises, with a total market share of nearly 9%; Among them, Nippon 2022 revenue of 23.1 billion yuan, is the only revenue of more than 10 billion enterprises. From the perspective of domestic TOP100 enterprises, the revenue of domestic enterprises is generally low, and the total revenue of "less than 500 million yuan" and "5-10 million yuan" accounts for more than 70%. From the perspective of scale expansion, the proportion of revenue of "5-10 billion yuan" and "3-10 billion yuan" waist enterprises has increased significantly in recent years.

Domestic brands are rising rapidly in recent years. In 2017, Oriental Yuhong entered the top ten for the first time, with a market share of 0.84%. In 2020, its market share rose to the fifth, with a market share of 1.48%. Sankishu entered the top 10 for the first time in 2018, with a market share of 0.88%, and rose to the fourth place in 2020, with a market share of 1.79%. In 2023, the overall performance of three trees exceeded Dulux, and the market ranking rose to second, surpassing Dulux. The market share of domestic leading brands increased rapidly.